The craze for collecting non-fungible tokens aka NFTs have gripped the digital elites as well as the lesser mortals. What’s the fuzz all about it in the art world?

Non-fungible token, Metakovan, crypto whale, Rarible, NFT art…

NFT and blockchain may sound too techy for someone, but it is solving the problem of most artists in the industry.

Just when we were starting to get the hang of cryptocurrency and all its vagaries, last few weeks we got drowned in a new bunch of terms that made at least some of us wonder if we would ever catch up with newfangled internet things.

Quick flashback: Christie’s , a fully on-chain auction platform dedicated to exceptional NFT-based art, has ended 2022 with global sales of $8.4 billion – the highest annual sales in art market history. Compared to 2021, it is a 17 per cent increase . The auction house broke several records in 2022 including selling an Andy Warhol (Shot Sage Blue Marilyn) for $195 million.This is the second highest price ever achieved for an artwork at auction.

Back home, Indian artists too are entering into NFTs. Shreya Daffney, a 29-year-old artist and architect, who has sold over 30 artworks in the last five years says that NFTs are giving a level playing feild for the artists as there is no middlemen involved in this.

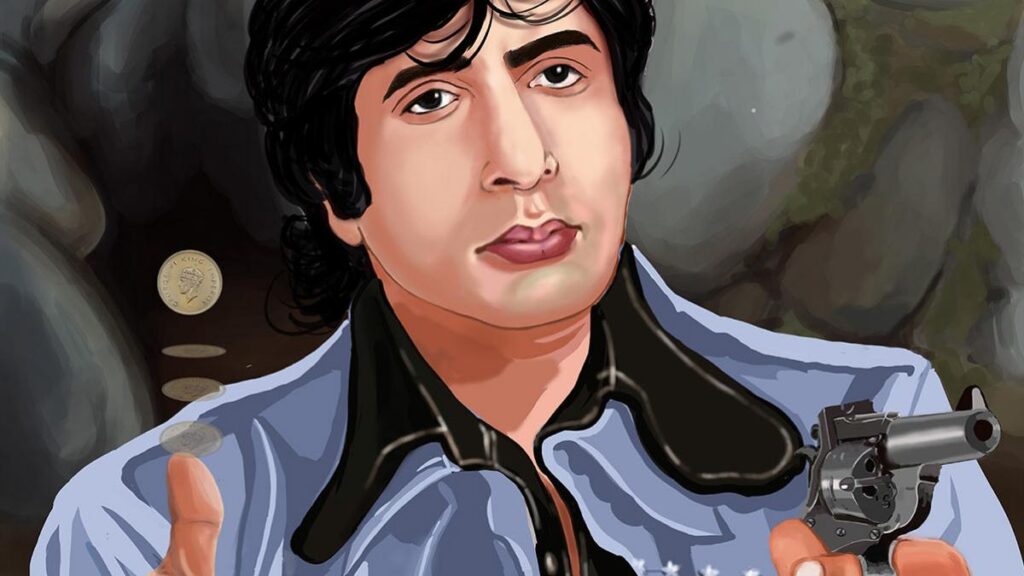

Celebrities including Amitabh Bachchan, Salman Khan, Rajnikanth and famous cricketing stars such as Sunil Gavaskar, Rishabh Pant, Yuvraj Singh have launched their own NFTs and the NFT ecoystem is evovling in India.

How is digital art even selling for such a high price?

The answer lies in a relatively new asset known as the non-fungible token (NFT). In economics, fungibility is the right to exchange an asset with other assets of the same kind. So when we talk about non-fungible assets, we’re basically dealing with stuff which can’t be replaced or exchanged.

In even simpler terms, if you exchange a Rupee for another Rupee, you’re still left with the same value of money. But each NFT has a totally separate value so that if you do exchange it for another NFT, you are left with a completely different asset. It could be anything from a JPEG file to a GIF, music track, video or even a tweet. The only common factor is that they exist solely in the virtual plane.

Owner: The One and Only

Yes, NFTs can be duplicated too. But the ‘true copy’ remains with just one owner. And because it’s all based on blockchain technology, there’s a permanent record of all the ‘legitimate owners’ so to speak. That means true ownership can’t be forged as the records are maintained across thousands of computers around the globe. Since NFTs can only have one real owner, it has set off a sort of NFT mania among the uber-rich, because – bragging rights, duh.

The true owner can also opt to get a cut or royalty everytime the asset changes hands. That’s a way to ensure the creator of the NFT gets a fair share of the proceeds.

People don’t just buy NFTs to spend their money. For some it may be a way to demonstrate their admiration for a particular artist or to acquire something that has personal significance.

Sounds cool. Wait, where does all this ‘action’ happen?

The funny thing about NFTs is that the more one talks about it, the more it feels like we’re in a realm of conjecture. Bear with us.

NFTs are made on certain blockchains like Ethereum or Polkadot. Think of them as the ‘factories’. They also have marketplaces like OpenSea, Nifty Gateway or Rarible where they get auctioned off to the highest bidders.

That’s alright but why am i sweating? It’s so hot here…

Hmmm. About that – Like we mentioned earlier, NFTs basically run on the same technology as cryptocurrency. And the single biggest downside of such tech is that it devours electricity like a hungry teenager who’s got the munchies.

Every single Ethereum transaction takes up over 60 kilowatt-hours of energy which is the amount of power consumed by a US household in two days! That’s also the same carbon footprint left behind by watching 4,800 hours of YouTube.

So yes, too much energy used. Emissions. Carbon footprint. Global warming. All this for things that you can barely lay your hands on. Ethereum has vowed to cut down its voracious appetite for electricity, but we don’t know when that’ll happen.

And then some more trouble

There is also the distinct possibility that digital assets may be turned into NFTs by people other than the true creators of that piece. Think about it. The creators needn’t always be crypto-geeks and may not even realise that somebody with a good command over the medium is making money off their assets until it’s too late.

What about Metakovan?

A little after Beeple’s piece was sold for $69 million, Christie’s revealed that the mysterious buyer was a Singapore-based crypto-investor who goes by the name Metakovan and owns Metapurse, the world’s largest NFT fund. And he’s of desi origin too. The crypto whale later said it was his mother who suggested the name Metakovan — which means king of Meta. In fact, there was a bit of palpable south Indian excitement on Twitter recently when he quoted lines from the ancient Tamil verse Thirukkural.

Fad or here to stay?

It’s easy to imagine there’s a lot of people who can’t stop frowning at the idea of non-fungible tokens, how much they’re selling for these days and at what cost to the environment. Many believe that these are just part of a short-lived craze that will fizzle out soon.

But there are also some who see tremendous potential. TBH, we may have to ride out the initial wave of intense excitement and see how things will settle down so as to make better sense of the future of NFTs.

2 Comments

Secure Time Bound NFT in India with leading NFT maarketplace Read more Upcric

Now that we have a basic understanding of what NFTs are, let us discuss the best sports NFT platform in India — Upcric Upcric